O&G stocks seen more attractive as Energy Index tumbles to over two-year low — analysts

KUALA LUMPUR (March 5): As the Bursa Malaysia Energy Index fell to a more than two-year low on Wednesday, market watchers see oil and gas (O&G) stocks being attractively valued, with some offering attractive dividend yields and growth potential.

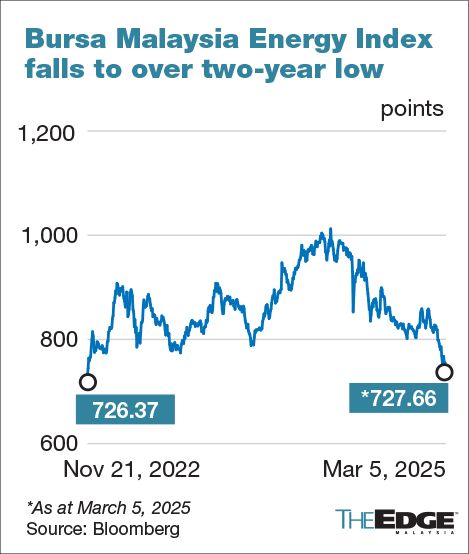

On Wednesday, the Energy Index — which tracks 23 O&G-related companies that are mostly service providers — dropped 1% to 727.66 points, the lowest level since November 2022.

Although the broader market rebounded, energy and telecommunications & media were the two sectors that posted negative returns, with the latter slipping 0.21%.

Since touching close to US$80 a barrel in January this year, Brent oil price has slipped 11.5% to US$70.36 a barrel as at 6pm on Wednesday.

Actively traded O&G stocks included Velesto Energy Bhd (KL:VELESTO), Dialog Group Bhd (KL:DIALOG), Bumi Armada Bhd (KL:ARMADA), Reservoir Link Energy Bhd (KL:RL), Sapura Energy Bhd (KL:SAPNRG) and Kinergy Advancement Bhd (KL:KAB).

Apex Securities analyst Ong Tze Hern opined that the sell-off has created buying opportunities in “some quality” O&G stocks, particularly those with stable earnings and dividends — such as Dayang Enterprise Holdings Bhd (KL:DAYANG) and Keyfield International Bhd (KL:KEYFIELD).

“The earnings are unlikely to drop much even though there is still dispute between Petronas and Petros on Sarawak oil exploration rights, because these two (Dayang and Keyfield) are mainly involved in brownfield projects, so dividend should sustain next year,” he told The Edge.

Dayang has been constantly paying out dividends since the financial year ended Dec 31, 2021 (FY2021). The Sarawak-based O&G services provider paid a total of 10 sen dividend per share in FY2024 versus 4.5 sen per share for the previous year.

Meanwhile, Keyfield, which was listed in April last year, declared a total dividend of 11 sen per share for FY2024.

Ong pointed out that Dayang has emerged as a frontrunner to secure upcoming contracts, taking cue from the Petronas Activity Outlook 2025-2027 report that indicates an increase in decommissioning projects.

He opined that the decent dividend yields could provide support for these stocks with defensive value amid the current market uncertainty. AskEdge data shows that Dayang and Keyfield offer dividend yields of 3.6% and 4.1% respectively.

“With dividend yield as the floor, it is a good entry if anyone wants an O&G exposure,” he said. “But, don’t expect the stocks to surge for significant capital gains,” he cautioned while maintaining a “neutral” call on the sector.

Ong’s top pick for the sector was Bumi Armada (KL:ARMADA), which is contingent on the success of a potential merger with MISC Bhd (KL:MISC) as the corporate exercise could strengthen its position in the high-demand floating production storage and offloading (FPSO) market.

Meanwhile, BIMB Research analyst Azim Faris Ab Rahim issued an “overweight” rating on the energy sector.

“Being defensive while vigilant on any trading opportunities that may arise. We believe the sector’s valuations are very attractive,” he noted.

That said, Azim Faris warned that Opec+’s (the Organisation of the Petroleum Exporting Countries and its allies) recent decision to proceed with its initial plan to boost oil output in April does not bode well for the O&G sector.

The content is a snapshot from Publisher. Refer to the original content for accurate info. Contact us for any changes.

Related Stocks

| ARMADA | 0.345 |

| BIMB | 2.240 |

| BURSA | 8.130 |

| DAYANG | 1.620 |

| DIALOG | 1.990 |

| KAB | 0.385 |

| KEYFIELD | 1.600 |

| MISC | 7.400 |

| RL | 0.205 |

| RL-WA | 0.015 |

| VANTNRG | 0.675 |

| VELESTO | 0.250 |

Comments